|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

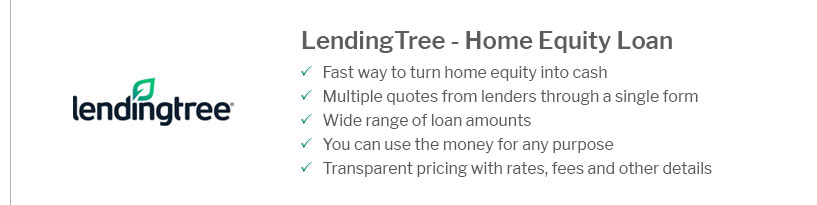

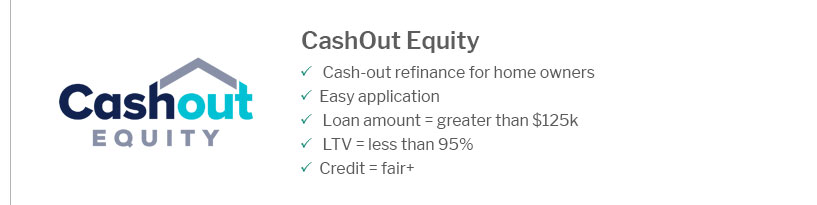

Understanding Texas Lending Refinance Reviews for HomeownersIntroduction to Texas Lending RefinanceRefinancing your home in Texas can be a crucial financial decision, and understanding the reviews of Texas lending refinance can provide valuable insights. These reviews often highlight the experiences of borrowers, detailing the benefits and potential pitfalls of working with different lenders. Key Benefits of RefinancingLower Interest RatesOne of the main reasons homeowners consider refinancing is to secure a lower interest rate. This can significantly reduce monthly payments and the total interest paid over the life of the loan. Accessing Home EquityRefinancing can also be a way to access home equity, allowing homeowners to fund renovations or consolidate debt. For more information, consider exploring fha streamline refinance home equity loan options. Common Challenges in Texas RefinancingCredit RequirementsLenders typically require a good credit score to qualify for the best refinancing rates. Borrowers with lower scores might face higher interest rates. Closing CostsRefinancing often involves significant closing costs, which can offset the savings from a lower interest rate. It's important to calculate these expenses carefully. Steps to Refinancing Your Mortgage

For additional details on refinancing options, check out fha streamline refinance florida. FAQs About Texas Lending Refinance Reviews

https://birdeye.com/texaslendingcom-149969901468496

Excellent service, superfast processing. Always available to address questions and concerns. Great work from Wes, who was on top of process from start to finish ... https://www.texaslending.com/reviews/

Excellent service, superfast processing. Always available to address questions and concerns. Great work from Wes, who was on top of process from start ... https://www.yelp.com/biz/texas-lending-dallas-13

My advice is to take the positive reviews on here and look who the Loan Officer was and ask for them by name when you call.

|

|---|